Our commercial property team considers the impact of the Energy Act 2011 on the owners of rental property .

The Energy Act 2011 (the Act) is a flagship policy of the coalition government and is the vehicle for implementing their “Green Deal” policy which offers financial support and incentives to improve the energy efficiency of buildings. Tied to the Act are a number of energy-related policies which owners of rented property should make themselves aware of.

Impacts for property owners

The key point for property owners to be aware of is that once the provisions of the Act are in force a landlord of a property which falls below a prescribed level of energy efficiency will not be able to let that property until energy efficiency improvements have been made.

The rules will apply equally to residential and commercial properties and must (under the provisions of the Act) be brought into force by 1 April 2018.

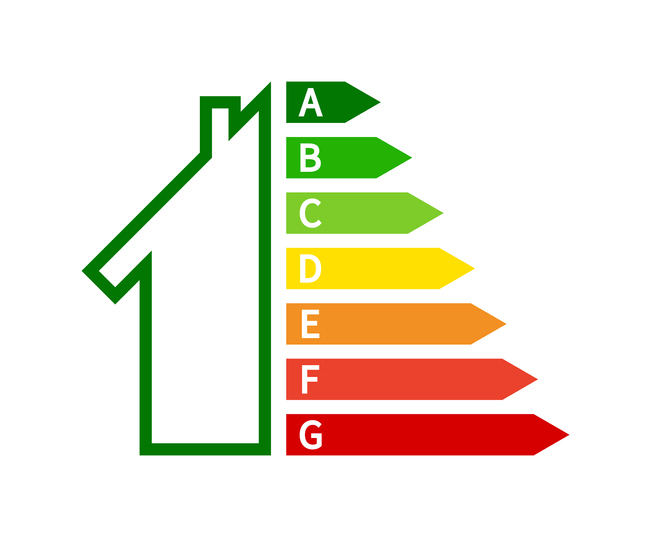

The level of energy efficiency required has not yet been set but will be shown by a property’s Energy Performance Certificate (EPC). A press release from the Department of Energy and Climate Change suggested that the level will be set at an “E” rating. If this is the case then any property with a rating lower than “E” will not be able to be let. This will be a concern for property owners but also lenders holding such property as security. At present a property with an “F” rating will be fully marketable and good security. Fast-forward to 2018 and the same property would have failed the test set out in the Act and ceased to be good security for the bank. Property owners may soon start to find that their lenders are asking about the energy efficiency of their portfolio and whether the cost of bringing the property up to the required standard has been factored into the owner’s business plan.

Although the detail of the requirements have yet to be set out, owners of rented property (both commercial and residential) should start preparing for these issues now by identifying any properties with a low energy efficiency rating and reviewing the recommendation reports attached to the most recent EPC. This process will show property owners (and their lenders) the scale of the measures which they may need to take to improve the energy performance of their portfolio to ensure they remain lettable.

How are improvements to be funded?

The amount of work required to improve the energy efficiency of a building may well be substantial. The Act acknowledges this and with the “Green Deal” sets out a funding mechanism to ensure that any works required to raise the EPC rating of a building can be implemented without an upfront cost to the landlord. The proposed mechanism is to provide for the cost of the works to be recoverable through the energy bills for the property. Effectively, the finance is based on a “pay as you save” principal with the cost of the works paid down through instalments generated by the energy savings of the works and collected with the energy bill.

However, the details of the how this is to work in practice remain vague and the Government has announced its decision to delay the roll-out of the Green Deal for business following widespread concern as to the complexity of the commercial property market and that the savings from efficiency works are likely to be insufficient to cover finance and capital costs in many commercial properties.

What can you do now?

This is an issue which property owners will not be able to avoid. As with anything, the best approach will be to face this head on and assess the scale of the works required now. If the issue is ignored and no action taken a property owner could end up with a property which they are unable to let.