Changes to Energy Performance Certificates

Lauren Walker, an Associate in our Real Estate Team, looks at the upcoming changes that will effect Energy Performance Certificates.

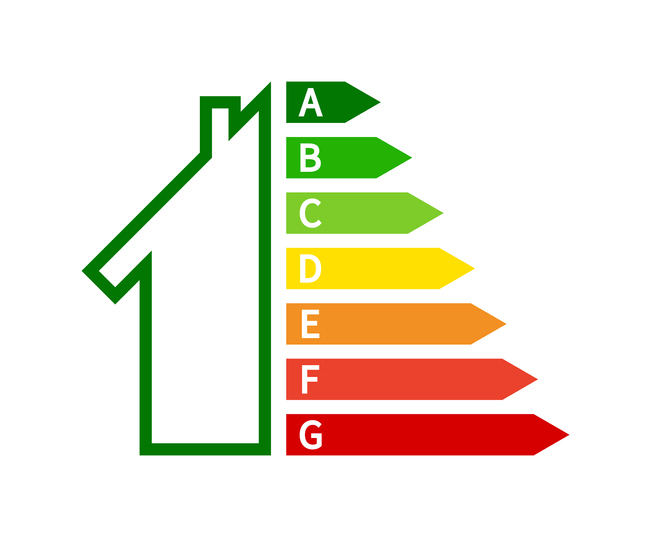

An Energy Performance Certificate (EPC) is a certificate which measures the energy efficiency of a property on a scale of A-G. Please refer to our related article on EPCs below.

The MEES (Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 (SI2015/962) stated that landlords are unable to grant a new tenancy unless the property has an EPC rating of E or above. These requirements came into force in April 2018 and did not affect existing leases. However, this is due to change and from 1 April 2023 every commercial property will need to meet the requirement of an E rating or above in order to continue to be let.

There are several exemptions to this rule which are explained below and, where an exemption applies, this must be registered accordingly on the PRS Exemptions Register. When registering the exemption, you must provide the address of the relevant property, the exemption type relied upon and a copy of the valid EPC for the property.

Exemptions

The prohibition on letting property with an EPC rating below an E does not apply if any of the following are applicable:

- High Cost Exemption – where the cost of making even the cheapest recommended improvements to the property would exceed £3,500 (inclusive of VAT). Where a landlord wishes to rely on this exemption, they must provide copies of three quotations for the works showing the costs exceeding £3,500 and confirmation that the landlord is satisfied the measures exceed this amount. This exemption is valid for five years and applies only to domestic properties.

- 7 Year Payback Exemption – where a recommended measure is not a “relevant energy efficiency improvement” because the cost of purchasing and installing it does not meet the 7 year payback test. This means that the expected savings on energy bills as a result of the measure being implemented do not exceed the cost outlay in carrying out the measures. Where a landlord wishes to rely on this exemption, they must provide copies of three quotes showing the cost of implementing the measure and confirmation from the landlord is satisfied that it does not meet the 7 year payback rule. This exemption is valid for five years and applies only to non-domestic properties.

- All Improvements Made Exemption – where all improvements have been made for a property, yet the property still remains sub-standard (i.e. below an E rating). Information contained in the EPC recommendation report can be relied upon to support this exemption. The exemption is valid for five years and applies to both domestic and non-domestic properties.

- Wall Insulation Exemption – this exemption provides that a recommended energy efficiency measure it not a relevant measure where it is cavity wall insulation or internal or external wall insulation and the landlord has obtained written expert advice indicating that the measure is not appropriate for the property due to its potential negative impact on the fabric or structure of the property. There are specific requirements as to who can provide the expert opinion and a copy of the opinion will need to be provided where the landlord wishes to rely on this exemption. The exemption is valid for five years and applies to both domestic and non-domestic properties.

- Consent Exemption – certain improvements may require third party consent before they can be installed, for example solar panels which require local authority planning consent or consent from lenders or other third parties. Where a landlord wishes to rely on this exemption, they must provide any supporting documentation showing consent was required and that such consent was refused or that it was granted subject to conditions the landlord is not able to reasonably comply with. This exemption is valid for five years and applies to both domestic and non-domestic properties.

- Devaluation Exemption – this exemption will apply where an improvement will reduce the market value of a property by more than 5% and the landlord has obtained a surveyor’s report confirming this. Where looking to rely on this exemption, the landlord must produce a copy of the report. This exemption is valid for five years and applies to both domestic and non-domestic properties. Please note, a landlord is still required to implement any other relevant improvements which are not covered by the surveyor’s report unless another exemption applies.

- New Landlord Exemption – this exemption applies in very limited circumstances where someone has suddenly become a landlord and as such it would be inappropriate or unreasonable to expect them to comply with the regulations immediately. There is a specific list of circumstances within which this exemption applies set out by the regulations. Where relying on this exemption, the landlord must confirm the date on which they became a landlord of the property and provide an explanation as to the circumstances in which they became a landlord. This exemption is valid for 6 months from the date on which they become a landlord and applies to domestic and non-domestic properties. At the end of the 6 month period, the landlord must, if they intend to continue letting the property, have either improved the energy efficiency of the property to at least an E rating, or registered another valid exemption in respect of the property should one be applicable.

If you need any further information or advice, please do not hesitate to contact our Real Estate team.